|

Drawing upon

shared traditions and values, the Japanese people joined together following

the Second World War to pursue the goal of rapid industrialization.

Employing a consensus-oriented approach, industrial leaders and commercial

banks worked in coordination with bureaucrats and politicians to develop

a manufacturing capacity that became the envy of the world.

With success, however, came new challenges. Lower-cost competitors

followed in Japan’s footsteps, and reinvigorated U.S. and European

firms -- who rationalized their operations and adopted many Japanese-style

practices -- began to present serious competition.

Japan suddenly found itself squeezed on both sides. The cradle to grave

progression funded by policy-based commercial lending – which

had so brilliantly transformed Japan into the world’s second

largest economy – now acted as a constraint. The Japanese people,

however, believed their problems were only temporary and were reluctant

to allow the painful economic and social adjustments necessary to restore

efficiency and competitiveness.

By the mid-1990s, however, Japanese leaders recognized the need for

comprehensive change. The “Action Plan for Economic and Structural

Reform” was adopted in 1996 to introduce greater flexibility

as a means to address inefficiencies and the high cost of doing business

in Japan. Dramatic progress has been achieved through deregulation

of Japan’s financial markets and other industrial and consumer

sectors. A new commercial code and more flexible labor practices have

been introduced, as well as more efficient and transparent accounting

and corporate governance regulations and other policy innovations.

(Click

here to access previous Focus newsletters for more details ).

|

| |

Japanese

firms continue to develop new products, maintaining an R&D commitment

reported by the Nihon Keizai Shimbun to total approximately $74 billion

in the current fiscal year – a 3.9% increase over FY2002 --

the fourth consecutive annual increase. Furthermore, the Financial

Times reports Japanese firms hold 6 of the top 10 international company

R&D budgets in the electronic and electrical industries, as well

as 4 of the top 10 positions in IT hardware and engineering, and

3 of the top 10 in automobiles & parts and chemicals.

- Japan

is a Global Leader in Mobile Telephony and the Wireless Internet

While

Internet activity in the U.S. is primarily driven via computers,

the average Japanese user is more likely to obtain access through

cellular handsets. As a result, Japan has become one of the world’s

most vibrant mobile telecommunications markets. With approximately

109 million Japanese citizens over 15 years of age, the Japanese

Telecommunications Carriers Association estimates there were 74.4

million cellular and 61 million mobile Internet subscribers in

Japan as of February 2003.

The 1999 introduction of iMode service by NTT DoCoMo set off the

dramatic growth seen in recent years. Customers use iMode for a

wide variety of purposes including receiving news and stock prices,

e-mail, shopping and banking online. iMode technology is also used

in car navigation systems to provide traffic news, weather forecasts,

parking updates and other services. At one point up to 50,000 subscribers

were signing up to use this service every day.

iMode succeeded -- not only in incorporating Internet access within

mobile telephony -- but also in charging for content. It uses a

unique micropayment system that DoCoMo (and other carriers who

have developed similar systems) are now introducing around the

world. Following its success, DoCoMo introduced IMT-2000 (FOMA),

the next-generation cell phone service in October 2001. It enables

the transmission of moving images and other new services.

Japanese companies and government agencies are now developing the

products, tools and infrastructure needed to develop this exciting

new communications medium. Wireless transmission speeds are increasing

at an amazing rate, with the current goal being to achieve 480

Mbps wireless Internet access by April 2004.

Taking advantage of this added bandwidth, NEC recently developed

a mobile phone that can receive digital TV broadcasting. Japan

plans to introduce terrestrial digital TV broadcasting service

this December in pilot areas including Tokyo, Nagoya and Osaka.

Within several years, it is hoped programs will be developed that

specifically target portable terminals. This will allow receipt

not only of digital TV programs, but also integrated services including

image, voice, sounds, data and other mobile applications.

Other interesting applications include a security system launched

by Total Life Service Community, a building maintenance company

in cooperation with Matsushita and Sanyo. It transfers images through

an interphone camera system installed at home to subscribers. Another

service will be launched by Secom, Japan’s largest security

service. It transfers visitor’s calls to a cellular phone,

giving the impression a home is occupied. A similar service allows

users to monitor pets and small children through phones or computers.

The Japanese experience offers many insights in how mobile communications

are changing human communications patterns. Two International University

of Japan Professors, Philip H. Sidel and Glen E. Mayhew recently

published

an informative report which provides

comprehensive insight into how Japanese consumers are utilizing

this emerging

medium.

- Japan

Catching-up and Surpassing the U.S. in Many Broadband Applications

Japan has lagged the U.S. and many other markets in terms of Internet

penetration, yet is rapidly closing the gap through low-cost broadband

service. At a cost of approximately $20 a month, it is not only

significantly less expensive than what is offered in the U.S.,

but includes a broad range of services relatively unknown in American

and European markets. The Wall Street Journal recently noted Japan

had 11.8 million high-speed subscribers as of August, up more than

sevenfold from 1.6 million two years ago. This penetration rate

of almost 10% -- is now similar to the U.S. Broadband service is

faster in Japan as well. The Wall Street Journal reports “An

album’s worth of music might take five minutes to download … in

the U.S. In Japan, some services … zap the data … in

16 seconds – and the monthly fee would still be half the

U.S. rate.

The potential is huge. Mitsubishi Research Institute estimates

Japan's broadband content market could be worth $6.4 billion by

2005. This is a sharp jump from the $1.5 billion seen in 2002.

Japan’s Ministry of Posts and Telecommunications provides

an even more optimistic estimate, forecasting demand for broadband-related

goods and services could be as high as $90 billion by 2007.

One application available to Japanese subscribers is the new BB

Games portal, which Softbank launched last summer. According to

Businessweek players can challenge others across the country for

a monthly fee of $8.50 to $13 per title. Businessweek reports Softbank

plans to offer up to 300 games by year-end 2004 -- with annual

gaming revenues of at least $400 million by 2006 Softbank also

believes E-learning and videoconferencing show great promise. Investors

seemingly endorse Softbank’s broadband approach -- as its

shares have appreciated dramatically over the past three months.

To further develop broadband capabilities, Japanese engineers are

now moving to validate the utility of IPv6 – the next generation

Internet protocol. It will be used in computers and communications

products as well as networks and other applications. Major characteristics

include: a) 128-bit IP addressing (compared to 32-bit in the current

IPv4), providing for a dramatic increase in the number of networks

and systems; b) network security reinforcement, and c) bi-directional/prioritized

data transmission.

Several Japanese firms are already launching products that link

current standards with IPv6. NEC now offers image distribution

systems. Hitachi markets software and equipment to facilitate the

development of proprietary networks. Fujitsu is also planning to

launch a system connecting current Ipv4 protocol with the next-generation

standard. The Nikkei Weekly estimates combined annual sales of

Ipv6-related products at these three firms to be ¥100 billion.

- Japan

Also Remains a Strong Contender in Other Emerging Information

Technologies

Japanese firms have been very active in the development of LAN

technology. New applications include home-based servers and telephones

that communicate with computers and make payments to vending machines.

Other products include cameras and appliances that utilize wireless

functions to transmit images, instructions and data. For example,

Hitachi Home & Life Solutions recently announced plans to market

seven Internet-enabled home appliances that allow users to send

instructions via cellular phones or computers by next spring.

To develop the protocols that will enable the operation of multiple

appliances via a single remote control, more than 100 home electronics

and telecom firms – including Matsushita, Sharp and Sanyo

as well as Microsoft and IBM Japan – recently announced plans

to team up with the government-affiliated Communications Research

Laboratory to devise a uniform standard.

Japan has also demonstrated real leadership in the development

of RF tags and RFID (Radio Frequency Identification) microchips

and the standards that will allow common, everyday objects to be

embedded with computer intelligence. These "smart" objects

are integral to the emerging field of “ubiquitious computing”.

It will allow these devices to communicate on a continual real-time

basis, promising innovations in fields including, but not limited

to, security, logistics, marketing and inventory control.

Japanese achievements in this area have resulted from the work

of Dr. Ken Sakamura of Tokyo University -- who first developed

TRON or "The Real-Time Operating System Nucleus" in 1984.

TRON has become the operating system driving most embedded systems

in Japan and promises to provide worldwide standards for this emerging

industry. Dr. Sakamura’s work has given rise to the TRON

Association, an

industry consortium with over 200 members. In a major step forward,

Microsoft announced last month it will work

with TRON to develop an operating system for network appliances.

As Microsoft Senior Vice President Susumu Furukawa noted in a Nikkei

newspaper interview “By combining with TRON, Windows CE can

devote itself to aspects of control on the display screen that

are closer to the user. We also have computers for the car and

digital appliances in mind”.

- Biotechnology

Constitutes Another Source of Potential Growth

According to the Japan Patent Office, Japan presently holds about

20% of worldwide biotechnology patents, compared to 21% for Europe

and 52% for the U.S. Large companies tend to dominate this sector

in Japan, accounting for about 76% of all filings. In contrast

universities lead in the U.S. with 53%.

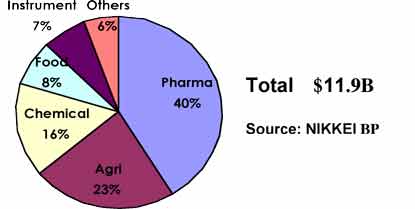

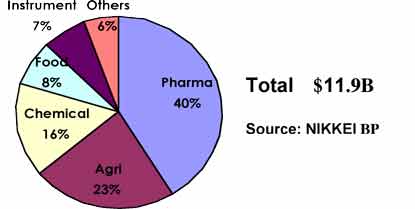

Japanese Biotech-Related Market (2002)

Biotechnology

research in Japan is built on a broader base than the U.S. and

Europe. A far greater number of patent filings have to do with

chemicals, agriculture and food, machinery and other sectors as

opposed to pharmaceuticals, which dominate in the U.S. and Europe.

Pharmaceuticals do, however, account for slightly less than half

of biotech revenues in Japan. The Nikkei BP reports nearly $5 billion

in pharmaceutical sales, including erythropoietin or EPO (20%),

monoclonal antibodies (11%), interferon (11%) growth hormones (10%),

insulin (8%) and other areas (41%). Agriculture and foods constitute

the next largest category, totaling $2.7 billion. This includes

maize (44%), corn (15%), granule (11%), rapeseed (11%), cotton

(6%), flowers (4%) and others (9%). EPO is used for the treatment

of anemia associated with end stage renal disease.

Chugai Pharmaceutical Co Ltd., which is now a member of the Roche

Group, one of the leading pharmaceutical companies in Europe, currently

controls about two thirds of Japan’s EPO market. This has

been achieved through sales of a product manufactured by Genetics

Institute, a US firm. An alliance between Kirin and Sankyo Pharmaceuticals

accounts for almost all of the rest through sales of an Amgen product.

This demonstrates the network of alliances and relationships between

foreign and Japanese large companies that have allowed these leading

companies to effectively penetrate and profit from the growing

market in Japan for biotech products.

While Japan lags the U.S. in terms of pure biotech firms, there

has been a dramatic increase in since 1999. Close to half of the

firms that commenced operations during this time were created through

spin-offs from larger companies, and another 25% from universities.

This is an encouraging trend, and is expected to continue given

increased labor and business flexibility and the steady growth

of this sector.

To promote a more robust biotech sector the Japanese government

is providing facilitated access to funding and encouraging closer

cooperation between universities and the private sector. National

Research Institutes became independent agencies since 2001 and

most national universities will adopt similar status during the

next fiscal year. This is likely to allow more effective commercialization

of patents and encourage a more entrepreneurial orientation.

Japanese universities have also begun to allow professor’s

to have side jobs and to increase their consulting activities.

Over 300 University start-ups have been established to date, as

well as 32 technology-licensing organizations (TLO) and incubators

to enhance the application of academic research. Two success stories

include the September 2002 $32 million IPO of AnGes MG Inc. and

TransGenic, Inc. last December. These are the first two publicly

traded venture firms in Japan to have been launched by university

researchers.

Japanese financial institutions are also enhancing the environment

for industries that rely on patents. In the largest lending backed

by intellectual property in Japan, Tomen Corp. affiliate Arysta

Life-Science Corp. has used its agrochemical patents as collateral

for a ¥35.5 billion syndicated loan from the UFJ, Sumitomo

Mitsui, Aozora and Sumitomo Trust banking groups. Mitsubishi Trust

is also launching a program allowing companies to place dormant

patents in trust accounts where the beneficiary rights will be

sold to investors.

The Japanese government is also moving to enhance biotech activity

through the establishment of industrial clusters. The Tokyo

Area Genome Network unites 7 prefectures and cities

to encourage genome analysis by government affiliates and universities

including RIKEN,

AIST and Tokyo University. The density of pharmaceutical and food

companies in Osaka provides another natural base for an industrial

cluster. Additionally, the Kobe Medical Industry Development

Plan promises innovations in tissue

engineering. Other clusters are

being launched in Hokkaido, as well as Tokai,

Toyama, Shikoku, Hiroshima and Fukuoka. One recently announced

Kobe-based program

consists of an effort by Takeda Chemical Industries and nine other

drugmakers in cooperation with the Translational Research Informatics

Center. It will conduct research on treatments customized to the

unique genetic makeup of individuals.

The exciting potential for Japanese biotech development is seen

in the growing number of dedicated bio-oriented venture funds,

many of which are highlighted in the table above.

- These

Growth Areas Constitute the New Frontier for Achieving Success

in Japan

Some

observers point to the preponderance of value-oriented and restructuring

deals in Japan and view this as evidence it is not possible to

initiate transactions that focus on new technologies or growth-oriented

businesses. While it is true the large-scale deals that have attracted

most media attention have been those involving distressed assets,

this is certainly not the case.

Many Japanese firms are actively dedicating themselves to developing

the global networks and product lines necessary to enhance their

competitiveness. They are coming to understand this entails greater

outreach and linkages with entities outside of Japan. As a result,

we are likely to see an acceleration of the number of cross-border

investments, mergers and acquisitions and other business and financial

arrangements that characterize successful global enterprises.

Furthermore, it is important to recognize the move toward a greater

emphasis on foreign investment is a relatively new phenomenon in

Japan. It should therefore be no surprise that initial movement

has been in the value and distressed area where there is a greater

need for immediate solutions. Japanese executives and government

leaders are, however, watching the success of the transactions

that have been achieved and it is simply a matter of time before

similar movement is seen toward more foreign involvement in the

growth areas highlighted above.

One can observe this trend in the activities of private equity

firms. Ripplewood, for example, recently shifted from an initial

emphasis on troubled financial institutions such as Shinsei and

leisure resorts such as Seagaia, to their most recent investment– the

$2.4 billion acquisition of Japan Telecom’s fixed-line telephone

business as well as other sectors where Japan has traditionally

defined its core competitiveness.

Recent comments by Ripplewood CEO Timothy Collins in the Financial

Times provide additional insight. Collins noted “There is

no limit to our appetite to investing in Japan”. The Financial

Times reports Ripplewood is now looking at opportunities in chemicals,

foodstuffs, branded services, consumer electronics and appliances.

Collins further stated “There is clearly a change in the

business culture – people realize they have to make profits.

[Japanese companies] see … we are going to be part of the

solution, not a thief trying to steal their family jewels.”

As Japan continues to open up and reform its economy, and further

progress is seen in its efforts to achieve a sustainable economic

recovery, U.S. corporate and portfolio investors would be wise

to maintain a closer look at the world’s second largest economy

and the many interesting opportunities that are beginning to emerge.

|