|

April/May 2004 Volume 5 Edition 3

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(full-text

Advisor below, or click on title for single article window)

KWR Advisor Economic Survey Please

take a moment to participate in the first KWR Advisor Economic

Survey. To register your views on the questions below,

please click on the following link. This should take no

more than about 5 minutes of your time. Results will be

published in the next edition. U.S. Markets – Is the Paradigm Changing? By

Scott B. MacDonald

While

higher interest rates may be a positive development over the

long-term, the initial period of change can have a negative

impact on markets. Concerns over a change in direction on the

interest rate front have already rippled through REITs (with

analyst calling April’s sell-off in REIT equity names “carnage”)

and Emerging Markets (with Brazilian bonds being particularly

hard hit). In 1994, rate increases caused a much higher degree

of spread volatility. Consequently, we acknowledge that credit

fundamentals are better, but that the short-term looks choppy

as the market digests the implications of higher rates.

It is important to clarify two things about the looming change in the U.S. interest rate regime. First, any increase in interest rates is likely to be gradual – with one, possibly two actions in 2004. Second, the place where the Fed now has rates is at the lowest level since 1958. Even with an increase of 25 or 50 bps in 2004 (possibly in August), the environment is still low on a historical basis. The Fed must be careful in raising interest rates for the very simple reason that by moving too quickly, it can choke off growth. And there are reasons for caution - consumer demand and housing are set to decline. In contrast to Corporate America, the U.S. consumer has not reduced debt. Continued spending has come from the positive impact of tax cuts and lower interest rates. Now, the impact of the tax cuts is diminishing and interest rates are expected to go up. At the same time, higher interest rates are casting a shadow over the housing market. The days of cheap money are coming to an end. What all of this means is that economic growth and employment generation will, in part, be balanced by slower consumer demand and housing. The Fed can begin the next phase of monetary policy with a view to keep inflation under control, though much will depend on job creation. It should be added that without job creation, the scenario could become dire. Look for interest rates to go up in 2004, but at a gradual pace, which could still be marked by considerable volatility as the market over-reacts. At some point, good earnings and economic growth will eventually trump interest rates. It is the passage from low rates to higher rates that remains the challenge. Until then, our advice is to reduce exposure and sell into any rallies. While interest rates have emerged as a dominant theme for U.S. corporate and stock markets, the worry about China is not far behind. In recent years massive amounts of foreign direct investment have poured into the country and portfolio investors have not been far behind. First quarter growth was a sizzling 9.7%, by far the fastest of any major economy. After two decades of sweeping industrialization, China’s economy has outstripped many domestic resources and led to a massive surge in commodity imports. The concern about China is that the economic miracle has the potential to rapidly deteriorate into an economic nightmare, which will ripple outward through the rest of Asia and the global economy in the form of an international commodity bust. Reality is likely to be a little more boring – China’s growth will slow, not crater; international commodities will see less demand from China, but the market is not likely to see a brutal price collapse (though the fate of individual companies will vary). China’s role in the global economy has changed drastically over the past 20 years. GDP growth has been at an average pace of 9% and the country is witnessing the expansion of a new middle class that is beginning to buy imported consumer goods. At the same time, China’s share of world trade has risen from less than one percent to almost 6%. Consequently, China is now one of the largest economies in the world and Asia’s second biggest behind Japan. It is also the world’s fourth largest trading nation. China’s growth spurt is not without problems. Much of its banking system lacks a professional credit culture, is politicized and carries a substantial bad loan burden. Transportation bottlenecks undermine efficient industrial development and raises costs. The country’s fast growth is rapidly outstripping natural resources such as oil, natural gas, iron and copper. China used to have enough oil for its own needs; and the Asian giant’s major oil companies are now competing for critical energy sources throughout Asia, the Middle East and Africa. Local governments have built up large debts, but there is little transparency about the extent of the problem. In addition, the country faces shortages of water, while there has been considerable environmental damage. The Chinese government is concerned that the pace of growth must be slowed to a more manageable 6-7% range. The danger is that government efforts to slow the economy overshoot, causing a severe downturn in growth and imports. The ripple effects would be considerable, especially if growth falls under 5%, opening the door to social turmoil as rising expectations are not met. Instead of a government-guided soft landing for the Chinese economy, the situation could be one of a hard landing, with multiple negative consequences for the global economy. A major economic crash in China would not only pull the rest of Asia down, it would ripple into the U.S. corporate bond market – at least that is what many investors are worried about. Although we have concerns over China, we do not think that it will collapse. What is most likely is that the government will increasingly apply pressure on the banks to limit further credit. Raising interest rates is a likely policy action. At the same time, a more concerted effort will be made to sell off bad loans into the market and clean up the major four government-owned banks. This implies that China will have to provide greater transparency and disclosure, which is likely to make many investors more cautious about buying local assets (as well they should be). Although the authorities are tightening credit in 2004, the slowdown in real GDP growth is likely to be more evident in 2005. We see China going through a “recessionary period”, with GDP growth slowing to the 6-8% range and industrial expansion cooling from 20% levels to levels closer to 10%. China’s slower pace of growth will have a negative impact on global commodity markets, but it will not be massively disruptive (due in part to still rising levels of demand from India) – a pause in what is likely to be a multi-year commodities bull market.

The Case for Higher Oil Prices By

Bill Powers, Editor, Canadian Energy Viewpoint When

I was in Calgary last year visiting several oil and

gas companies, the CEO of one of Canada’s best

run junior oil and gas companies looked across the

conference table and said something that stuck in my

mind: “Get ready for $50 oil!” Such a bold

prediction, made when nearly every Wall Street and

Bay Street analyst was lowering his 2004 oil price

prediction, underscores the massive divide in opinion

on the future price of oil. The

term “conventional oil” is used to refer

to oil that is produced from conventional reservoirs and

does not include oil from tar sands, polar areas, deepwater

areas or oil from coal or shale. Conventional oil accounts

for 95% of all oil produced today and will remain the determining

factor in world production for the foreseeable future.

According to Dr. Campbell, world oil discovery peaked in

the 1960’s

and has declined steadily since. We are now to a point

where we produce four barrels for every one we discover.

Clearly,

this is an unsustainable situation since long-term discovery

and production must mirror each other to some degree.

Campbell

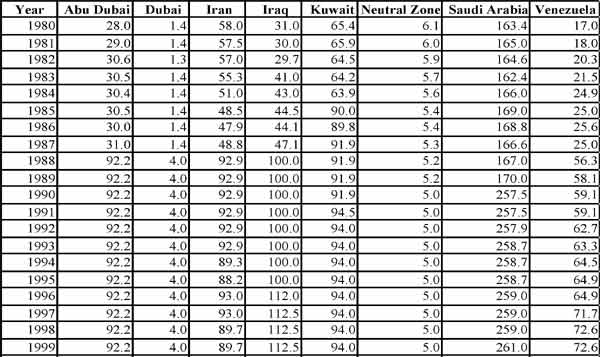

contends that OPEC reserve estimates are politically

motivated. Kuwait

is an excellent example of what is wrong with the way OPEC

countries report reserves. The country reported a gradual

decline in its reserve base from 1980 to 1984. This should

be expected from a mature producing country. However, in

1985 the country reported a 50% increase in reserves with

no corresponding discovery. The Kuwaiti government increased

its reserve estimate due to the implementation of an OPEC

production quota system that set country production levels

based on country reserves. Kuwait was not alone in increasing

its reserve estimates for political reasons. In 1988, Abu

Dubai, Dubai, Iran and Iraq all significantly increased

their reported reserves for political reasons. Even

OPEC heavyweight

Saudi Arabia reported a massive increase in reserve estimates

in 1990 for similar reasons.

Japan – The Gods of Credit Are Smiling? By Scott B. MacDonald While some of the glow may be coming off of China’s “economic miracle”, Japan is looking better. The Nikkei is up for the year, the banks are slowly beginning to lend again and reduce bad loans, and exports are robust. Equally important, the fundamental credit story for corporate Japan is finally improving. In the first three months of 2004, Standard & Poor’s raised its ratings on seven Japanese corporations and financial institutions and lowered four, continuing the trend from 2003, the first year in which upgrades exceeded downgrades since 1990. Equally significant, the number of upward outlook revisions was 28, compared with only one downward revision. S&P even changed the outlook on its sovereign rating (AA) for Japan from negative to stable. S&P was not alone in indicating improving credit quality for Japan. In early April Moody’s raised Japan’s sovereign ratings from Aa1 to Aaa, due to improving economic conditions as well as a rise in foreign exchange reserves to $770 billion. Later in April Moody’s placed four major Japanese banks on review for possible upgrades. Fitch also released a Special Report on Japanese banks, in which it applauded the improving credit quality of the sector. Moody’s, Standard & Poor’s and Fitch share a view that Japan is probably on the right track economically. The key word here is “probably”. The three agencies fully recognize that the banking sector is making headway in reducing nonperforming and troubled loans and that the Koizumi reforms are even trickling down into local government. Yet, they also recognize that problems remain – ranging from weak public finances, export dependence and a yet to fully restructure domestic sector. On April 19 investors were made to remember that despite the improving creditworthiness of the Japanese corporate world, problems are not far from the surface. It was revealed in the press that UFJ, the country’s fourth largest bank, was told by the Financial Services Agency that it needed to set aside an extra Y300 billion (($2.8 billion) to cover bad loans. This news promptly resulted in a major sell-off of bank and financial stocks on the Nikkei and raised fears that other institutions could have similar problems. The problems at UFJ were followed by the decision of DaimlerChrysler Corp. not to proceed with a bailout plan of $6.5 billion for Mitsubishi Motor Corps, Japan’s only non-profitable major automaker. The events at UFJ and Mitsubishi Motor underscore that tough challenges still remain. We believe that the Japanese corporate world is making progress. At the same time, the passage to self-sustainable economic growth cannot be taken for granted. Significant parts of the economy continue to have substantial problems and are still dragging their feet over making any meaningful changes. Consequently, we have a positive outlook for the short-term, but remain cautious about the medium term. It is easy to forget in good times, that further reforms are still needed. Without those reforms, the good times will not continue – an important message for both the government and the private sector.

By

Scott B. MacDonald In

July Japan will go the polls to re-elect half of the

242 seats in the upper house of the Diet. We do not

expect any major changes. Although the Democratic Party

of Japan (DPJ) is seeking to capture more seats than

the LDP (which now holds 50 seats), Koizumi remains

a skillful player in the political game. The DPJ’s

battle plan is to convince the public that Prime Minister

Koizumi’s economic reforms have failed and that

the sending of Self Defense Force troops to Iraq is

a mistake. Although the success of Koizumi’s

reforms is indeed questionable, the Japanese economy

is on the upswing and Nikkei is trading well above

the lows of recent years. Unemployment is down to 5%

from a high of 5.5%. In addition, Koizumi’s attention

to raising Japan’s standing in international

affairs has been one of the more significant areas

of success.  For more information on CSFB DNA'S new SD+ Information Service - click on the banner above Mexico: A Stable Credit in an Unstable Time By Jonathan Lemco

Emerging Market Briefs By

Scott B. MacDonald

Hong Kong: Hong Kong's unemployment rate fell slightly to 7.2 percent in the three months ending February on improved job prospects in the restaurant and finance sectors, officials said Thursday. Economists had expected the jobless rate to be 7.1 percent for the period until Feb. 29, compared to 7.3 percent in the November-January period. Unemployment declined across a wide variety of business sectors, including financing, insurance, restaurants, communications and recreational services, the government said. It said total employment grew by 9,500, to 3.25 million during the period. Hong Kong is continuing its recovery from the severe acute respiratory syndrome crisis, which devastated the economy by keeping tourists away, pushing joblessness to a record 8.7 percent in May-July last year.  Indonesia – the Cost of Illegal Logging: There are always trade offs between activities in the legal and black market economies. In Indonesia a heavy price is being paid for illegal logging, as legally established firms are suffering. Around 70 per cent or 322 of 460 companies operating in the upstream sector of the timber processing industry in the country have collapsed over the past few years mainly as a result of rampant illegal logging. There are many factors but illegal logging was the main culprit causing the bankruptcy of the companies said Agung Nugraha, deputy secretary of the Indonesian association of forestry companies (APKI). Rampant illegal logging a caused big shortage in the supply of log raw material for the country's plywood, sawn timber and pulp factories, Nugraha said. He said the industries need around 20 million cubic meters of logs a year and supply from natural forests is much less than 10 million m3. He said illegal logging has caused damage to 43 million hectares of natural forests in the country reducing the country's tropical forests from 153 million hectares to 98 million hectares over the past year. Malaysia – The

March 29th Elections: On March 29th, Malaysia voters

went to the polls to elect a new government. As was the

case over the last several decades, the ruling multi-ethnic

coalition, the Barison Nasional or BN, won handily, reasserting

the dominant role of the United Malays National Organization

(UMNO) within the majority Malay community. The BN captured

198 of the 210 (90%) seats in the federal parliament

or 64.4% of all votes cast (up from 56.6% in 1999 and

just below the 65% it scored in 1995). This was decidedly

good news for the standing Prime Minister Abdullah Badawi,

who had earlier assumed the leadership role from longstanding

Prime Minister Mohammad Mahathir. Despite considerable

speculation as the strength of the Islamic issue in swaying

voters to opt to non-BN parties, Badawi marked his first

outing as national leader with a sweeping victory, which

should provide him the opportunity to further put his

own personal stamp on the direction of the country.

Pakistan – Foreign

Exchange Down: Pakistan's foreign exchange reserves slipped

slightly to $12.560 billion in the week to March 13,

down $5 million from the previous week, the State Bank

of Pakistan said on Thursday. The central bank gave no

reason for the fall, but bankers said the slide was mainly

due to quarter-end repayments of foreign debt. The central

bank said its direct holdings were $10.764 billion and

those of commercial banks were $1.796 billion. The central

bank changed the method it uses to calculate foreign

reserves in 2002. It now monitors the total liquid foreign

reserves, including previously undisclosed foreign exchange

deposits by banks.

Philippines – Less Money in Reserve: The Philippines' gross international reserves are expected to fall to $15 billion at the end of this year from $16.9 billion as of end 2003, the central bank said on Thursday. The central bank uses the reserves to intervene "from time to time" to support the weak peso, but "we will not use up our gross international reserves to defend an unrealistic FX rate", Governor Rafael Buenaventura told Reuters on Wednesday. The international reserves comprise the foreign currency holdings of the central bank, including gold and International Monetary Fund special drawing rights. Turkey – A Little Less Change in the Pocket: Turkey's central bank foreign currency reserves fell $946 million to $31.853 billion in the week ending on March 12. Gold reserves were unchanged at 1.558 billion. Turkey's total gross reserves on February 27, the latest available data, were $47.126 billion, of which $12.187 billion was with private institutions, including commercial banks. The central bank held the rest. Travel – Something

to Do In London: By

Scott B. MacDonald For

anyone with a sense of history and an interest

in good cup of tea or coffee while

in

London, the

place to go is the Bramah Museum of Tea and Coffee.

Located on 40 Southwark Street, Bankside (London

SE1 1UN phone: 020 7403 5650), this compact museum

provides a comprehensive view of the world of

coffee and tea, brought to life in a walk-through

exhibition

of ceramics, metal and graphic arts. The tearoom

serves traditional afternoon teas and coffees.

And if you are lucky, you might well meet Mr.

Edward Braham, the museum’s founder and tea industry

veteran.

Past Issues of the KWR International Advisor

KWR

International, Inc. (KWR) is a consulting firm

specializing in the delivery of research, communications

and advisory services with a particular emphasis on public/investor

relations, business and technology development, public

affairs, cross border transactions and market entry programs.

This includes engagements for a wide range of national

and local government agencies, trade and industry associations,

startups, venture/technology-oriented companies and multinational

corporations; as well as financial institutions, investment

managers, financial intermediaries and legal, accounting

and other professional service firms. KWR

International, Inc. (KWR) is a consulting firm

specializing in the delivery of research, communications

and advisory services with a particular emphasis on public/investor

relations, business and technology development, public

affairs, cross border transactions and market entry programs.

This includes engagements for a wide range of national

and local government agencies, trade and industry associations,

startups, venture/technology-oriented companies and multinational

corporations; as well as financial institutions, investment

managers, financial intermediaries and legal, accounting

and other professional service firms. KWR maintains a flexible structure utilizing core staff and a wide network of consultants to design and implement integrated solutions that deliver real and sustainable value throughout all stages of a program/project cycle. We draw upon analytical skills and established professional relationships to manage and evaluate programs all over the world. These range from small, targeted projects within a single geographical area to large, long-term initiatives that require ongoing global support. In addition to serving as a primary manager, KWR also provides specialized support to principal clients and professional service firms who can benefit from our strategic insight and expertise on a flexible basis. Drawing upon decades of experience, we offer our clients capabilities in areas including:

For further information or inquiries contact KWR International, Inc. Tel:+1- 212-532-3005, Fax: +1-212-799-0517, E-mail: kwrintl@kwrintl.com © 2004 - This document is for information purposes only. No part of this document may be reproduced in any manner without the permission of KWR International, Inc. While the information and opinions contained within have been compiled by KWR International, Inc. from sources believed to be reliable, we do not represent that it is accurate or complete and it should be relied on as such. Accordingly, nothing in this document shall be construed as offering a guarantee of the accuracy or completeness of the information contained herein, or as an offer or solicitation with respect to the purchase or sale of any security. All opinions and estimates included within this document are subject to change without notice. KWR International, Inc. staff, consultants and contributors to the KWR International Advisor may at any time have a long or short position in any security or option mentioned in this newsletter. This document may not be reproduced, distributed or published, in whole or in part, by any recipient without prior written consent of KWR International, Inc. |